Ocwen Short Sale Package 2013-2024 free printable template

Show details

18 Mar 2013 ... Important Information about the Short Sale Process ..... Send Owen the completed package and supporting documentation. Methods to return ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your short sale 2013-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short sale 2013-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short sale online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit short sale selling form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Ocwen Short Sale Package Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out short sale 2013-2024 form

How to fill out short sale:

01

Gather the necessary paperwork, including financial documents, hardship letter, and sales contract.

02

Consult with a real estate agent or attorney experienced in short sales for guidance and advice.

03

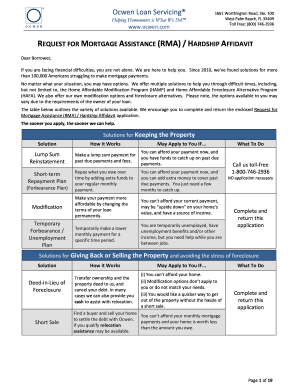

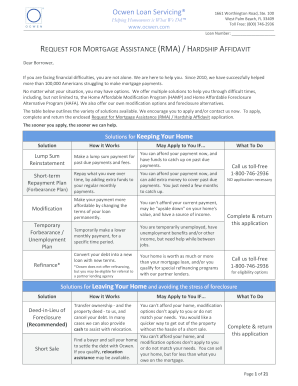

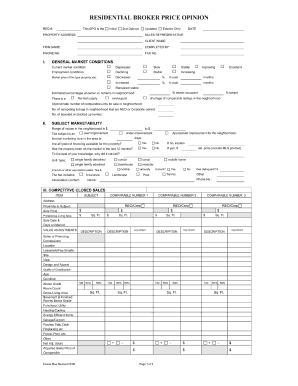

Complete the necessary forms provided by the mortgage lender, such as the Request for Mortgage Assistance and the Short Sale Package.

04

Provide all requested documentation and information accurately and promptly to the lender.

05

Work with the lender to negotiate the terms of the short sale, including the sale price, possible deficiency balance, and timeline.

06

Ensure that all parties involved, including the buyer, seller, and lender, are in agreement and have signed the necessary agreements and contracts.

07

Conduct the short sale transaction, which may involve listing the property, finding a buyer, and going through the closing process.

Who needs short sale:

01

Homeowners who are unable to keep up with their mortgage payments and are facing financial hardship.

02

Individuals who have experienced a significant decrease in property value and owe more on their mortgage than the current market value of their home.

03

Borrowers who are unable to qualify for a loan modification or other foreclosure alternatives and want to avoid foreclosure by selling their property.

Video instructions and help with filling out and completing short sale

Instructions and Help about sale request package form

Fill short ocwen package download : Try Risk Free

People Also Ask about short sale

Who must give approval for a short sale to go through?

How do you document a short sale?

Why might a lender approve a short sale?

What is a short sale in MN?

What is a short sale approval letter?

How does short sale work?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file short sale?

The borrower or homeowner who is selling a property for less than the amount they owe on their loan is the one who is required to file a short sale.

What is the purpose of short sale?

A short sale is a transaction where a homeowner sells their home for less than the remaining balance on the mortgage. This type of sale is often used as an alternative to foreclosure, allowing homeowners who can no longer afford their mortgage payments to avoid the negative credit consequences of foreclosure and get out from under their mortgage debt.

What information must be reported on short sale?

When it comes to short sales, the seller is typically required to disclose the following information to the lender and/or buyer:

- The amount of the outstanding loan that is being forgiven;

- The amount of any deficiency that the seller may be liable for in the event that the sale price is lower than the outstanding loan balance;

- Any other fees associated with the short sale;

- The estimated closing costs for the sale;

- The estimated timeline for the completion of the sale;

- The status of any other offers that have been made on the property;

- The estimated market value of the property;

- Any special terms or conditions that are attached to the short sale;

- Any estimated tax consequences associated with the short sale; and

- The seller's current net worth statement.

What is the penalty for the late filing of short sale?

The penalty for late filing of a short sale will depend on the rules of the specific stock exchange or other trading venue, but generally includes fines and other disciplinary action. It may also include suspension of trading privileges and other penalties.

What is short sale?

A short sale refers to a real estate transaction in which the homeowner sells their property for less than the amount owed on the mortgage. In such cases, the lender agrees to accept the proceeds from the sale as full payment for the mortgage debt, despite it being less than the total amount owed. Short sales typically occur when the homeowner is facing financial hardship and is unable to continue making mortgage payments.

This type of sale requires the approval of the mortgage lender, as they must agree to waive the remaining debt. Short sales are often pursued when the property value has declined significantly, and the homeowner owes more on the mortgage than the current market value of the property. By engaging in a short sale, homeowners can avoid foreclosure and mitigate the potential negative impact on their credit.

How to fill out short sale?

Filling out a short sale requires careful attention to detail and thorough understanding of the process. Here are the steps to fill out a short sale:

1. Gather necessary documents: Collect all the required documents such as financial statements, hardship letter, bank statements, pay stubs, tax returns, and any other supporting financial documents needed by your lender.

2. Consult with a real estate agent or attorney: Work with a professional experienced in short sales who can guide you through the process and ensure accuracy in filling out the necessary paperwork.

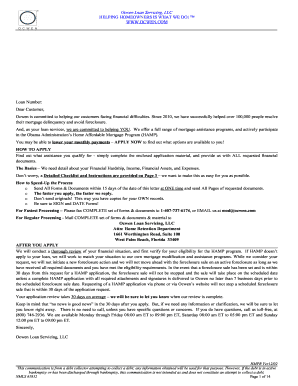

3. Contact your lender: Notify your lender about your intention to pursue a short sale and request their short sale package. This package will include the specific forms and documents required by the lender for the short sale application.

4. Review the short sale package: Carefully review the package provided by your lender, ensuring you understand each document and its purpose. Take note of the specific forms required in the package.

5. Complete the necessary forms: Fill out all the forms as accurately and neatly as possible. Be sure to provide all the required information, including property details, financial information, and the reason for the short sale (financial hardship).

6. Write a hardship letter: Prepare a detailed hardship letter explaining your financial difficulties that have led to the need for a short sale. Be honest and provide supporting documentation if available.

7. Organize and submit the documents: Once you have completed all the necessary forms and gathered all required documentation, organize them in a logical order. Make copies for your records and send the completed package to your lender along with any additional required documents they have specified.

8. Follow up with the lender: After submitting your short sale package, follow up with your lender regularly to ensure they have received it and ask if any additional information is needed.

9. Be responsive and cooperative: Respond promptly to any requests or inquiries from your lender throughout the short sale process. This will help expedite the approval process.

Remember, the specific forms and requirements may vary depending on the lender and your situation, so it's crucial to consult with professionals and follow their guidance throughout the short sale process.

How can I send short sale for eSignature?

When your short sale selling form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit ocwen short sale package straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing short sale package pdf, you can start right away.

How do I edit ocwen short sale on an Android device?

You can edit, sign, and distribute short sale sell form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your short sale 2013-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ocwen Short Sale Package is not the form you're looking for?Search for another form here.

Keywords relevant to ocwen forms loan modification

Related to loan nmls 1852 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.